Table of Contents

ToggleUnderstanding Bamboo Charcoal Wood Veneer and Its Market Value

Bamboo charcoal wood veneer is a new-generation decorative surface material that combines natural bamboo fibers with activated bamboo charcoal through high-temperature compression and UV surface treatment. It provides:

- Real wood appearance with modern durability

- Fire resistance, moisture proofing, and antibacterial properties

- Environmentally friendly composition and low formaldehyde emission

In the last decade, it has become widely used in hotel interiors, commercial buildings, office partitions, and residential walls, gradually replacing traditional wood veneer and PVC marble sheets.

As a leading Chinese factory specializing in bamboo charcoal wood veneer, we have closely tracked market changes over the years. Between 2020 and 2024, global prices fluctuated significantly due to shifts in raw material cost, logistics, and global renovation demand. Understanding these dynamics helps importers and distributors make better purchasing and inventory decisions.

Price Trends of Bamboo Charcoal Wood Veneer (2020–2024)

Based on our factory’s production data and export records, the following summarizes the average FOB China price trends over the past five years.

| Year | Average Price Range (FOB China) | Market Situation |

|---|---|---|

| 2020 | $15–25/m² | Pandemic disruptions, material shortage, and high logistics cost |

| 2021 | $18–30/m² | Rapid recovery in overseas projects, resin cost surge |

| 2022 | $20–35/m² | Global inflation and energy crisis push manufacturing cost higher |

| 2023 | $15–32/m² | Cost stabilization, freight normalization, product differentiation |

| 2024 | $14–30/m² | Mature market, stable supply chain, eco-certification premium |

2020: Production Interrupted and Freight Soared

The COVID-19 pandemic severely impacted China’s manufacturing supply chain. Bamboo raw material collection, adhesive supply, and shipping routes were disrupted.

Freight from China to the U.S. and Europe increased nearly threefold, directly pushing veneer export prices to around $25/m² for high-grade products.

2021: Recovery and Surging Demand

As overseas hotels, offices, and apartments resumed construction, demand rebounded strongly. Adhesive and coating chemicals saw price hikes due to oil price increases.

Export orders rose by nearly 40% compared to 2020, and veneer with UV coating and anti-scratch finishing became especially popular.

2022: Inflation and Energy Price Shock

Energy costs (electricity, fuel, transport) sharply increased under global inflation. At the same time, environmental regulations in China required factories to adopt cleaner production methods.

This year saw the highest price point — $20–35/m² — though advanced factories using automated lines managed to stabilize costs better than small workshops.

2023: Market Adjustment and Quality Segmentation

By mid-2023, container freight rates returned to pre-pandemic levels, easing export costs. However, customers began focusing on certifications (E0, B1, CE) and surface customization.

Basic panels stabilized around $15–20/m², while high-end decorative panels with deep textures reached $30/m².

2024: Price Stability and Brand Differentiation

With stable bamboo raw materials and improved production efficiency, prices became more predictable.

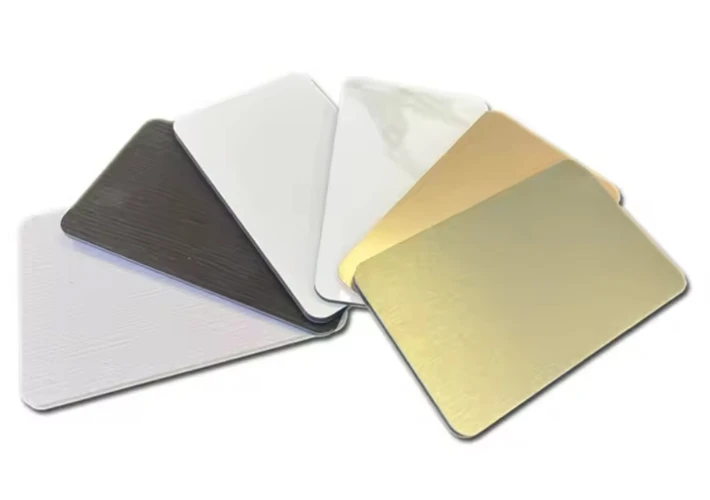

Factories with strong R&D capabilities introduced bamboo charcoal metal composite panels and sound-absorbing veneer systems, which added value and slightly increased high-end pricing.

Factors Affecting the Price of Bamboo Charcoal Wood Veneer

Several key elements contribute to price fluctuation. Our factory continuously analyzes these to maintain competitive cost control and transparent quotations.

(1) Raw Material Cost

The main inputs — bamboo powder, fiberboard substrate, and bamboo charcoal powder — account for 35–40% of total production cost.

When bamboo harvest seasons are disrupted or energy for carbonization rises, prices follow suit. Factories with long-term raw material bases can maintain more stable costs.

(2) Production Process and Technology Level

Advanced facilities use:

- Automatic hot-pressing lines

- Precision UV coating equipment

- CNC cutting and edge-wrapping systems

These technologies improve yield rate and surface consistency, reducing waste by 10–15%.

Factories relying on manual production often face quality inconsistency and higher per-unit cost.

(3) Energy and Labor Costs

Electricity and labor contribute 15–20% of the total cost. From 2020–2022, China’s average electricity price rose 12%, and labor costs increased due to labor shortage during lockdowns.

Automation investment can offset these rises, giving large factories an advantage.

(4) Shipping and Packaging Costs

Before the pandemic, shipping a 40HQ container to the U.S. cost around $3,000; during 2021–2022, it peaked above $12,000.

In 2024, freight returned to $4,000–$5,000, stabilizing export quotations. Packaging with moisture-proof film and reinforced pallets also adds 3–5% to cost but ensures safe delivery.

(5) Market Demand and Project Procurement Cycles

During hotel or office renovation booms, demand spikes rapidly. Distributors in the Middle East, Southeast Asia, and North America often compete for bulk orders, pushing short-term prices upward.

In low seasons, manufacturers offer volume-based discounts to maintain stable production.

Cost Structure: How Factory Pricing Is Calculated

As a direct Chinese manufacturer, we maintain transparent pricing. Below is an approximate breakdown per square meter (FOB China):

| Cost Component | Percentage | Description |

|---|---|---|

| Bamboo & Charcoal Base Material | 30–35% | Includes fiberboard, bamboo charcoal powder |

| Adhesive & UV Coating | 15–20% | Depends on surface finish (matte, gloss, texture) |

| Labor & Processing | 15% | Cutting, hot-pressing, polishing |

| Energy & Machinery Maintenance | 10% | Electricity, equipment wear |

| Packaging & Logistics | 10–15% | Export carton, wooden pallets, inland freight |

| Quality Control & Certification | 5–10% | SGS, ISO9001, E0, B1 testing |

| Factory Margin | 8–12% | Adjusted based on order size |

By optimizing supply chain management and adopting automated production lines, our factory successfully maintains stable export pricing even during raw material volatility.

Global Market Insight and Future Price Forecast (2025–2027)

(1) Stable Growth in Demand

Bamboo charcoal wood veneer will continue to grow globally, especially in:

- Hotel and office interior decoration

- Eco-friendly building materials projects

- Luxury residential furniture and walls

Based on industry data, the annual global market growth rate is expected to reach 6–8% between 2025 and 2027.

(2) Moderate Price Fluctuation

The average export price is predicted to stay between $15–28/m², supported by:

- Stable bamboo cultivation and supply in Asia

- Reduced energy pressure

- Technological advancements lowering unit cost

Factories with environmental certification and OEM capacity will command a premium due to increasing global demand for sustainable products.

(3) Product Upgrading Trends

Future development will emphasize:

- Fireproof and acoustic veneer combinations

- Recyclable substrate materials

- Customized texture and color solutions

High-end customers, especially in Europe and North America, will prefer certified low-VOC, recyclable materials, pushing factories toward sustainable manufacturing.

Why Choose a Professional Chinese Factory Supplier

Selecting the right supplier is crucial to ensure consistent pricing, reliable quality, and stable delivery.

As a leading bamboo charcoal wood veneer factory in China, we provide:

Direct factory pricing — eliminating middlemen and ensuring the best cost performance.

Advanced production equipment — automatic hot-pressing, UV coating, and CNC cutting lines for consistent quality.

Comprehensive quality control — each batch is inspected for thickness, color consistency, and surface hardness.

International export experience — shipped to over 40 countries, with professional packing and documentation.

OEM & customization service — available for special patterns, dimensions, and branding.

Technical support and market guidance — we share regular market trend reports and assist clients with local sales data.

Our mission is not only to supply veneer panels but also to help our global partners grow their business through stable quality, reasonable pricing, and professional consultation.

Conclusion

Over the past five years, the price of bamboo charcoal wood veneer has reflected the challenges and resilience of the global decorative materials industry.

From pandemic disruptions to recovery and stabilization, the market has matured significantly.

Today, bamboo charcoal veneer remains one of the most cost-effective and eco-friendly decorative materials, offering long-term value for importers and contractors.

As a professional manufacturer in China, we combine strong production capacity, strict quality control, and real-time market analysis to deliver competitive, sustainable, and high-quality products to our international clients.

💡 Looking for a Reliable Bamboo Charcoal Wood Veneer Supplier?

We welcome distributors, wholesalers, and project contractors worldwide to cooperate with us.

We offer free product catalogs, samples, and technical videos to help you evaluate our quality before bulk purchasing.

Partner with us — and gain a trusted, professional bamboo veneer manufacturer in China.